Business

How much gold is permitted from Dubai to India?

Dubai is well-known for its iconic structures, thrilling events, and its well-deserved reputation as one of the best shopping cities in the world. Given these facts and India’s extraordinary popularity of gold jewelry, it should come as no surprise that expatriates adore purchasing gold there and are curious about the gold limit from Dubai to India.

In order to protect themselves against inflation, ex-pats frequently convert their savings to gold. In light of this, the Indian Central Board of Indirect Taxes and Customs imposed a limit on the amount of gold that could be imported into India from Dubai a few years ago.

Let’s move on to our tips and information on how much gold you can transport from Dubai to India without delay.

The gold limit from Dubai to India

The main factors encouraging foreigners to purchase gold in Dubai are the lower costs and high quality. One of the busiest markets for purchasing gold in Dubai is the Deira Gold Souk, where buyers from all walks of life prefer to shop.

However, over the past few years, the Indian government’s restrictive customs duties have had an impact on the import of gold into India from Dubai and other emirates.

Duty Free Allowance

Any Indian passenger with a valid Indian passport issued under the Passport Act of 1967, who has resided abroad for more than one year, is eligible to bring gold jewelry into India in their baggage, according to the Central Board of Indirect Taxes and Customs (CBIC) website:

For male passengers, gold jewelry with a combined weight of 20 grams and a maximum retail price of INR 50,000 is exempt from customs duty.

Customs duty is waived on gold jewelry up to a combined weight of 40 grams and a maximum purchase price of INR 100,000 for female passengers.

Children are included in the duty-free allowance for gold jewelry traveling from Dubai to India. Providing they have lived in Dubai or the other country other than India for a year or more.

Keep in mind that the duty-free allowance only applies to gold jewelry if you’re an Indian traveling from Dubai to India with gold. Customs duties must be paid on gold in the form of bars or coins.

Limits on carrying Gold

Passengers are required to pay customs duty if they bring more than the permitted amount of gold into India from Dubai.

Passengers with valid Indian passports who have spent more than six months in Dubai or another foreign country are permitted to check one kilogram of gold in the form of bars or coins from Dubai to India.

If they bring more gold than is allowed from Dubai to India, they must pay custom duty fees.

From Dubai to India, the customs duty on gold increased in 2019 from 10% to 12.5%.

Exceeding the maximum gold limit

The maximum amount of gold per passenger that can be brought from Dubai to India is 10kg, according to the website of the UAE Embassy. It includes the total weight of the gold that a traveler is hauling, including any jewelry.

For coins and bars weighing more than 1 kg, the customs duty is 36.05%. Therefore, even though this higher limit may be permitted, it’s not all that common to see people taking more gold than 1kg at a time.

Requirements for importing more than the limit

- The customs duty on all excess gold shall be paid in convertible foreign currency.

- Passengers must provide all necessary proof of purchase and other documentation to avoid the seizure of goods at the airport.

- Failing to meet the strict requirements and declaration may lead to detention, prosecution or confiscation until all paperwork and documentation are complete.

- The gold bars must have all the necessary inscriptions. The information has to include the total weight, manufacturer, serial number.

- A major condition for importing gold above 1 KG is that the passenger should not have brought any gold or other precious metals and gemstones to India in the last six months, exceeding the maximum gold limit from Dubai to India.

- During the short visits to the country, the passenger has not availed any form of exemption from paying customs duty on gold in India.

- Gold jewellery studded with expensive gemstones and pearls is not allowed to be imported to India.

- A passenger has to bring the gold as a piece of checked baggage, or the other option is to import the gold within fifteen days of their arrival in India as unaccompanied baggage.

- The passenger can obtain the permitted quantity of gold from the Customs bonded warehouse of the State Bank of India and Metals and Minerals Trading Corporation.

- The passenger must file a detailed declaration in a prescribed form before the Customs officer upon their arrival in India.

- The passenger must state their intention to obtain gold from the customs bonded warehouse and pay the customs duty before the clearance.

It’s always important to be aware of the most recent customs regulations when it comes to the gold limit from Dubai to India. Before returning home or arriving in Dubai from your home country, make sure to review the Dubai Airport Banned Items List. The limitations are set up to nullify gold smuggling into the nation and reduce the economic deficit.

To improve passenger convenience, the Indian Central Board of Excise and Customs plans to create a new set of customs gold limits for India. When finalized, the new regulations will make it simpler for visitors to India who are bringing gold from Dubai and other countries to clear customs.

FAQs

How much gold can you legally carry to India?

How much gold can you carry out of UAE?

Can I wear gold from Dubai to India?

How can I carry gold from Dubai to India?

Can I take gold jewellery in hand luggage?

How do you declare gold at the airport?

Can I take gold biscuit to India?

What is custom duty on gold in India?

Which country has cheapest gold?

Banking

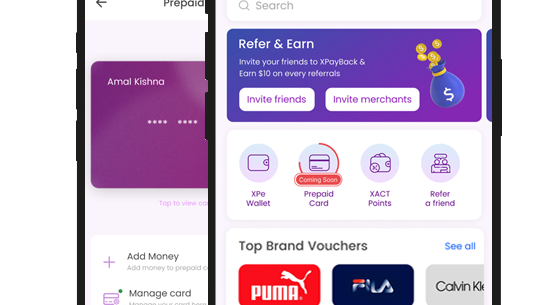

XPayBack Deals: The Ultimate Way to Save on Shopping!

XPayBack Deals is a great way to save money while shopping. It allows customers to explore new products and services at a discounted price, and the best part is that there are no hidden fees or charges. Customers can easily browse through the deals available on XPayBack’s platform and purchase them with just a few clicks.

Participating merchants can benefit from XPayBack Deals by attracting new customers and increasing their sales. Merchants can create customized deals to promote their products or services and reach out to a wider audience. This helps merchants to expand their customer base and grow their business.

XPayBack prepaid cardholders can enjoy even more benefits with XPayBack Deals. By using their prepaid card as a payment method, they can get an additional cashback on top of the deal discount. This means that customers can enjoy double savings on their purchases.

XPayBack Deals is also a great way to discover new products or services. Customers can try out new experiences and explore different options without having to worry about the cost. With XPayBack Deals, customers can make informed purchasing decisions while enjoying great savings.

In conclusion, XPayBack Deals is a fantastic feature that benefits both merchants and customers. It offers a wide range of deals across various categories, providing customers with great opportunities to save money while enjoying new experiences.

HOW TO USE XPAYBACK DEALS

Exploring XPayBack Deals: A Step-by-Step Guide.

1. Launch the app or visit http://xpayback.com and browse through the categories.

2. Click on the deal that catches your interest to view the details, including Fine Print and Redemption Instructions.

3. Hit the green BUY NOW button and proceed to the confirmation page.

4. Verify the voucher details, such as redemption dates, Fine Print, and price, then click on PAY NOW.

5. Congratulations! You’ve successfully purchased a XPayBack voucher, and you don’t need to print it out as all redemptions are via the mobile app.

Apple

iOS 18 is the upcoming major update for iPhones

iOS 18 is the upcoming major update for iPhones, expected to be unveiled at Apple’s Worldwide Developers Conference (WWDC) on June 10, 2024. Here’s what we know so far:

- Focus on AI: A major focus of iOS 18 is rumored to be artificial intelligence (AI). This could include features like AI-powered text summarization or improved Siri functionality.

- App Updates: Many built-in apps, like Messages, Notes, and Calculator, are expected to receive updates and new features.

- RCS messaging: There are rumors that Apple might finally add support for RCS messaging, allowing for improved messaging features between iPhones and Android devices.

Release and Compatibility:

- iOS 18 will likely be available for public beta testing in July 2024.

- The official launch is expected in September 2024, alongside new iPhone models.

- Devices that can currently run iOS 17 are likely compatible with iOS 18, including the iPhone XR and newer models.

More Information:

While these are some of the rumors and leaks surrounding iOS 18, we’ll have to wait for the official announcement at WWDC to know for sure what features will be included. You can find more information about iOS 18 by searching online for “iOS 18 features” or “iOS 18 release date”.

iOS 18 supported devices

iPhone 15

iPhone 12

iPhone 15 Plus

iPhone 12 mini

iPhone 15 Pro

iPhone 12 Pro

iPhone 15 Pro Max

iPhone 12 Pro Max

iPhone 14

iPhone 11

iPhone 14 Plus

iPhone 11 Pro

iPhone 14 Pro

iPhone 11 Pro Max

iPhone 14 Pro Max

iPhone XS

iPhone 13

iPhone XS Max

iPhone 13 mini

iPhone XR

iPhone 13 Pro

iPhone SE

iPhone 13 Pro Max

(2nd & 3rd gen)

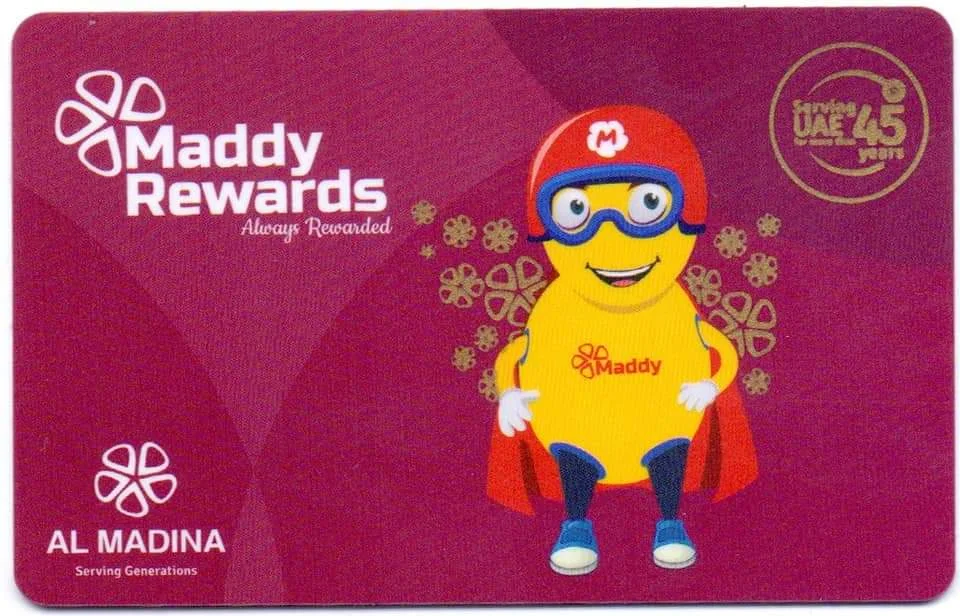

The Al Madina Maddy Card is a loyalty program offered by Al Madina Hypermarkets in the UAE. It rewards customers for shopping at their stores and allows them to earn points that can be redeemed for discounts on future purchases.

Here are some of the benefits of using the Al Madina Maddy Card:

- Earn points for every purchase: You earn points on every dirham you spend at Al Madina Hypermarkets. The number of points you earn depends on the type of product you purchase. For example, you may earn more points on groceries than on electronics.

- Redeem points for discounts: You can redeem your points for discounts on future purchases at Al Madina Hypermarkets. The redemption rate varies depending on the number of points you have earned.

- Get personalized offers: You may receive personalized offers and promotions based on your shopping habits.

- No fees to join or use: There is no fee to join the Al Madina Maddy Card program, and there are no fees associated with using the card.

Here are some of the frequently asked questions about the Al Madina Maddy Card:

- How do I sign up for the Al Madina Maddy Card?

You can sign up for the Al Madina Maddy Card online at the Al Madina Hypermarkets website or at any Al Madina Hypermarket store. You will need to provide your name, email address, and phone number.

- How do I earn points?

You earn points on every purchase you make at Al Madina Hypermarkets. The number of points you earn depends on the type of product you purchase and the current promotions. You can check the current point earning rates on the Al Madina Hypermarkets website or app.

- How do I redeem points?

You can redeem your points for discounts on future purchases at Al Madina Hypermarkets. You can redeem your points at the checkout counter or online. The redemption rate varies depending on the number of points you have earned. You can check the current redemption rates on the Al Madina Hypermarkets website or app.

- What are the benefits of using the Al Madina Maddy Card?

The Al Madina Maddy Card is a great way to save money on your groceries and other household items. You can also earn points on other purchases, such as electronics and clothing.

- How do I check my point balance?

You can check your point balance online at the Al Madina Hypermarkets website or app. You can also check your point balance at any Al Madina Hypermarket store.

- What is the validity of the Al Madina Maddy Card?

The Al Madina Maddy Card is valid for 1 year from the date of activation.

- Where can I redeem my points?

You can redeem your points at any Al Madina Hypermarket store in the UAE.

- What if I lose my Al Madina Maddy Card?

If you lose your Al Madina Maddy Card, you can contact the Al Madina Hypermarkets customer service hotline to request a replacement card.

- How do I contact the Al Madina Hypermarkets customer service hotline?

The Al Madina Hypermarkets customer service hotline can be reached at 800-MADINA (623462).

I hope this information is helpful!

Al Madina Maddy Card FAQ:

Signing Up and Using the Card:

- How do I sign up for the Al Madina Maddy Card?

- You can sign up online at the Al Madina Hypermarkets website, through their app, or at any Al Madina Hypermarket store. You’ll need to provide basic information like name, email, and phone number.

- Is there a fee to join or use the card?

- No, joining and using the Al Madina Maddy Card is completely free.

- Where can I use my Maddy Card?

- You can use your Maddy Card at any Al Madina Hypermarket branch across the UAE.

- Can I use my Maddy Card online?

- Currently, using the Maddy Card for online purchases is not available.

Earning and Redeeming Points:

- How do I earn points?

- You earn points on every purchase at Al Madina Hypermarkets. The number of points earned depends on the product category, promotions, and current offers. Check the website or app for specific rates.

- When do points expire?

- Points are valid for 1 year from the date they are earned.

- How do I redeem points?

- You can redeem points for discounts on future purchases at any Al Madina Hypermarket branch during checkout. You can also redeem points through the app (if available).

- What is the redemption rate?

- The redemption rate varies depending on the number of points you have and current promotions. Check the website or app for details.

- Can I use points and a coupon together?

- Generally, points and coupons cannot be used together in a single purchase.

Checking Balance and Card Management:

- How do I check my point balance?

- You can check your balance online through the Al Madina Hypermarkets website or app, or by visiting any store and inquiring at the customer service counter.

- What if I lose my Maddy Card?

- Report a lost card immediately at any Al Madina Hypermarket store or by calling their customer service hotline. They can deactivate your lost card and issue a replacement.

- How do I update my personal information associated with the card?

- You can update your information online through the website or app, or by visiting a store and informing the customer service team.

Additional Information:

- Does the Maddy Card offer personalized promotions?

- Yes, you might receive personalized offers and promotions based on your shopping habits.

- Can I link my Maddy Card to other loyalty programs?

- No, linking the Maddy Card with other programs is currently not possible.

- Where can I find the latest information about the Maddy Card program?

- For the most up-to-date information and FAQs, visit the Al Madina Hypermarkets website or download their app. You can also reach their customer service hotline at 800-MADINA (623462).

I hope this comprehensive FAQ answers your questions about the Al Madina Maddy Card!