India

Effect of Goods & Services Tax (GST) on the Indian Agricultural Sector

Ever since GST was implemented across India in 2017, it created quite a stir as to how would things work, how it would impact various sectors, how would people get GST credit, and how it would reduce indirect taxes. Today we look at 2017 to 2022 how it has affected the Indian Agricultural Sector.

Indian Agricultural Sector & GST

GST in India

To first understand the impact of GST we need to understand what is GST, the agriculture in India and then GST’s mark on it. In a nutshell, GST is Goods & Services Tax which went live in 2017 after a series of board meetings, the process of implementation and amendment bills. After the approval of Lok Sabha & Rajya Sabha, this new tax system was implemented to reduce a range of indirect taxes such as Value Added Tax (VAT), Service Tax, Purchase Tax, Excise Duty and so on which were being levied from the people. So, it is 1 tax that is applicable all over India.

Agriculture in India

The agriculture sector is crucial to the growth of the Indian economy. Rice, wheat, sugarcane, and spices are just a few of the agricultural products that India produces and exports to other countries. Agriculture is one of the key businesses providing employment in rural India. Consequently, taxation on the agricultural industry is quite important to the economy. The greatest contributor to India’s overall GDP is the agriculture sector. It accounts for roughly 16% of the Indian GDP.

In India, the agriculture industry is largely excluded from the GST. In essence, agricultural products including fresh seafood, dairy, fruit, and vegetables are exempt from the GST.

Positive Impacts of GST on Agri-Activities

1. Better Supply Chain

Under the new regulations, no tax will be levied on the storage, which will lower the farmers’ tax burden. It also has reduced food waste associated with storage tax and has provided farmers with the opportunity to sell their goods at a good price.

2. Input Tax Credit with Tax Exemption

Each dealer is provided with an Input Tax Credit (ITC) for the tax previously levied for each addition. This creates a transparent and hassle-free system while the movement of agri-food. The previously imposed surplus tax is only collected (on consumption) if agricultural products are marketed by manufacturers or on the output of goods.

3. Reduced Transportation Time

As agricultural products are perishable, their transportation plays a vital role while distributing them. As a single tax rate has been imposed, it should empower and strengthen as now transporting has become convenient.

4. Intergovernmental Trade Made Easy

Earlier during intergovernmental trade, a lot of permissions and licences were required from states and which made every transaction difficult. This led to a lengthy process and there were complications when agricultural products needed to be transported. Because of GST, a lot of loopholes in this process have now gone, making the trade of such items very smooth.

Future Plans to be Achieved by GST

- The overall aim of GST has lessened the burden on the agricultural industry. However, the government has had to increase taxes on items like fish, meat, chicken, dairy products, condensed milk, dried fruit, jellies, and other items. With time, the government plans to reduce taxes on the same, so there’s a balance maintained.

- The building cost has marginally increased because of 18% GST but on the other hand, people would be paying less tax overall.

Kodaikanal was established in 1845 to serve as a refuge from the high temperatures and tropical diseases during the summer in the plains. It is a popular tourist destination and is referred to as the “Princess of Hill stations” with much of the local economy based on the hospitality industry serving tourism.

Kodaikanal is a town and hill station in Dindigul district in the state of Tamil Nadu, India. It is situated at an altitude of 2,225 m (7,300 ft) in the Palani hills of the Western Ghats. As per the 2011 census, the city had a population of 36,501.

What is the speciality of Kodaikanal hills?

The cool and misty weather, the scenic beauty of the rolling hills and the wooded forest of Kodaikanal and its surroundings will mesmerize any visitor throughout the year.

Which is highest, Ooty or Kodaikanal?

Ooty has an elevation of 2,400 meters, with Kodaikanal just a little behind at an elevation of 2,133 meters. Kodaikanal is known as the “Gift of the Forest”, while Ooty is lovingly referred to as, “Queen of Hill Stations”.

Which is colder, Ooty or Kodaikanal?

Temperature: Both hill stations have a pleasant climate during monsoon, with cooler temperatures compared to the surrounding plains. However, Kodaikanal generally experiences milder weather during this time, with temperatures often staying more moderate than Ooty.

What food is special in Kodaikanal?

Dosas, idilis, Upma, Parota, Sambhar, Rasam, Paysam, Kesari, Sweet pongal and lots more.

Which is the best month to visit Kodaikanal?

Kodaikanal can be visited through the year, but the ideal time is in the winter between October and March. The summer and monsoon months from April to June and between July and September respectively, also make for a good Kodaikanal trip.

Which is the nearest airport to Kodaikanal?

Madurai

Kodaikanal doesn’t have an airport, so if you want to come here by air, then you will have to fly down to the nearest airport which is in Madurai, which is 120kms away, or Trichy which is 150kms away. Another airport that is often used to get to Kodaikanal is Coimbatore airport which is 175km away.

What is the special thing in Kodaikanal?

Kodaikanal is home to almost 10 unique waterfalls. The most visited of these are Liril Falls, Bear Shola Falls, Silver Cascade Waterfall, Vattakanal Waterfalls, Fairy Falls, Kumbakkarai Falls, Pambar Falls, and Thalaiyar Falls.

Tamilnadu

Thoppi Amma: Who Is She? What is known about Topi Amma, the mysterious hat mother of Tiruvannamalai, Tamil Nadu

Thoppi Amma: Who Is She? What is known about Topi Amma, the mysterious hat mother of Tiruvannamalai, Tamil Nadu

We frequently hear about fascinating individuals and spiritual tales in India. A mysterious woman known online as Thoppi Amma (also referred to as Topi Amma or Toppi Amma) has gained popularity recently. In Tamil Nadu’s temple town of Tiruvannamalai, people huddle around her as she strolls. This is everything we know about Hat Mother Thoppi Amma.

Many people in India look for spiritual meaning and frequently think that particular persons or objects are endowed with special abilities. This belief stems from a combination of their personal views, their upbringing, and superstition. As a result, they frequently perceive those in their immediate vicinity as sacred and endowed with extraordinary powers. Thoppi Amma, also known as Topi Amma or Toppi Amma, is the most recent addition to this. She is revered as the hat mother of Tiruvannamalai, a holy city in Tamil Nadu. Numerous images and videos posted on social media show Thoppi Amma strolling through Tiruvannamalai’s streets as large crowds follow in her wake.

Because of her distinctive attire, which consists of a long skirt that is worn out and ragged, a full-sleeved shirt, and a hat, she is known as the “hat mother” or Thoppi Amma. Her modest look belies the respect she is held by the community, who trust in her to bring good fortune and blessings. The mysterious aura that surrounds Thoppi Amma still captivates locals and users of social media.

Thoppi Amma: who is she?

Online videos that have gone popular claim that the people of Tiruvannamalai, Tamil Nadu, think Thoppi Amma, sometimes called Topi Amma or Hat Mother, will bring luck and favors. However, no one is sure where this idea originated. Online videos and pictures show her being followed by large groups of people, who share the food or cup she tosses as a sanctified offering known as “prasad.” Unintentionally, she’s turned into a local legend, with many believing she has magical abilities. It’s ironic because despite having advanced dementia, Thoppi Amma remains oblivious to the legend that surrounds her. She frequently appears with a worn-out shirt, cap, and skirt.

The tiny village of Tiruvannamalai in Tamil Nadu, it seems on the internet, gives Thoppi Amma an air of mystery. The reasons for the mystery surrounding her remain unknown, as is her life story and how she came to be in Tiruvannamalai.

Faq;

Toppi Amma miracles

Topi Amma story

Topi Amma Arunachalam wikipedia

Topi Amma History

Thoppi Amma history in Tamil

Why Topi Amma is famous

Education

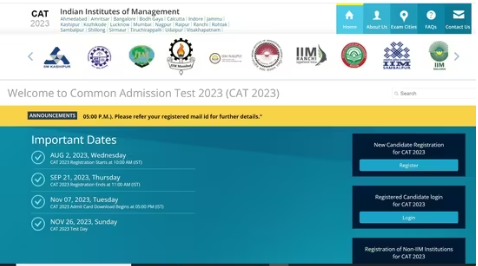

CAT 2023 response sheet out on iimcat.ac.in, link to download

IIM CAT 2023 response sheet released at iimcat.ac.in.

CAT 2023 Response sheet: The Indian Institute of Management (IIM) Lucknow has published the response sheet of the Common Admission Test (CAT) 2023. Candidates who have appeared in the examination can log in to the website iimcat.ac.in and download it.

“Objection form and Response sheet for CAT 2023 appeared candidates is live from 05th Dec 2023 (11:00 A.M.) till 08th Dec 2023 (05:00 P.M)” reads the official website.

Direct link

The entrance test took place on November 26 in three slots. There were 66 questions in the exam, of which 24 were from Verbal Ability and Reading Comprehension (VARC), 20 were on Data Interpretation and Logical Reasoning (DILR) and 22 were on Quantitative Ability (QA).

A total of 3.28 lakh candidates were registered for CAT 2023 and 2.88 lakh or 88 per cent of them appeared.

The duration of the test was 120 minutes (160 minutes for PWD candidates).

Direct link to download CAT 2023 answer key

IIM Lucknow has also invited feedback from candidates. Those who want to raise objections to the preliminary answer key can do it till December 8.

Candidates’ objections will be reviewed by a panel of experts and if found valid, revised answers will be published on the final key.

After that, the results of the entrance examination will be announced. Candidates who qualify in CAT 2023 can then apply for admission to their preferred B-schools.